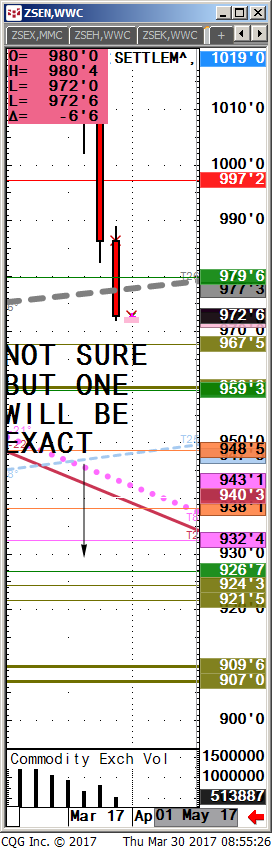

Part of being a successful trader requires having levels that you confident about, followed by a trading methodology that allows you to shoot bigger with a tighter risk profile. Last month gave a precise example with soybeans where, for instance, if you were a 10 lot trader you might buy 5 @ OLB#1 thin $9.23, especially since I had cited a confluence of events at 9.22, and then the other 5 at the OLB between 9.06 and 9.0975. Stop either under $9.00, or tighter depending on your risk profile and time frame. The chart displayed below had these levels mapped out with two sets of

Beans going into Q2-17″end, 6.30. These are the only buy levels I would advise. Check if 9.09 held 1st time miss before $9.06 buy the olive line.

olives. Interpretation of my charts, with two 2- OLB#2’$ (thick) @ 909.75 & 9.06 basis Aug futures, illustrate why you would want to buy beans for a host of reasons, including better odds.

Below are a slew of markets live with many of them again at critical high-impact trading levels.

Let’s talk your levels,

your market

312 957 8248

Some will not make sense to you but the levels are important right here right now for high speed computers

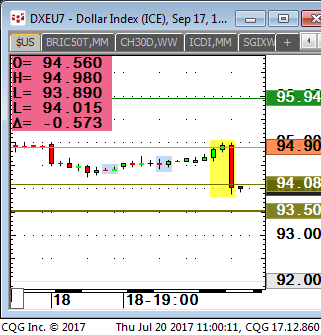

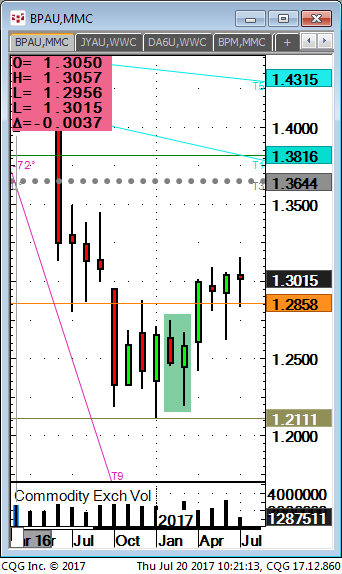

euro currency doom and gloomers getting run out of shorts. No olive buy like the B Pound but breakout. No comment.

h

h

CHECK THE SOFTS THAT ALSO HIT BUT BUYS WHEN BEANS DID. BUY INFLATION NOW, AND ON BREAKS in my opinion.

Think if your a high frequency trader with me the daily levels when you need one.

These will be the next level, rules of course.

Beans 1017.5 has been talked about for weeks. Make these levels and rules your friend. Lets talk.