Good Morning Farmers and Traders,

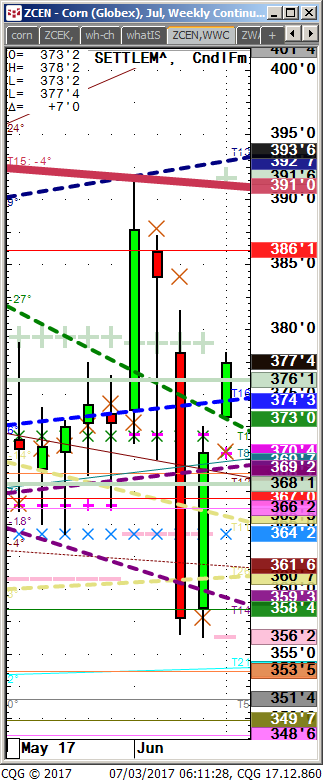

Dec corn 404.5 a sell level for old crop longs.

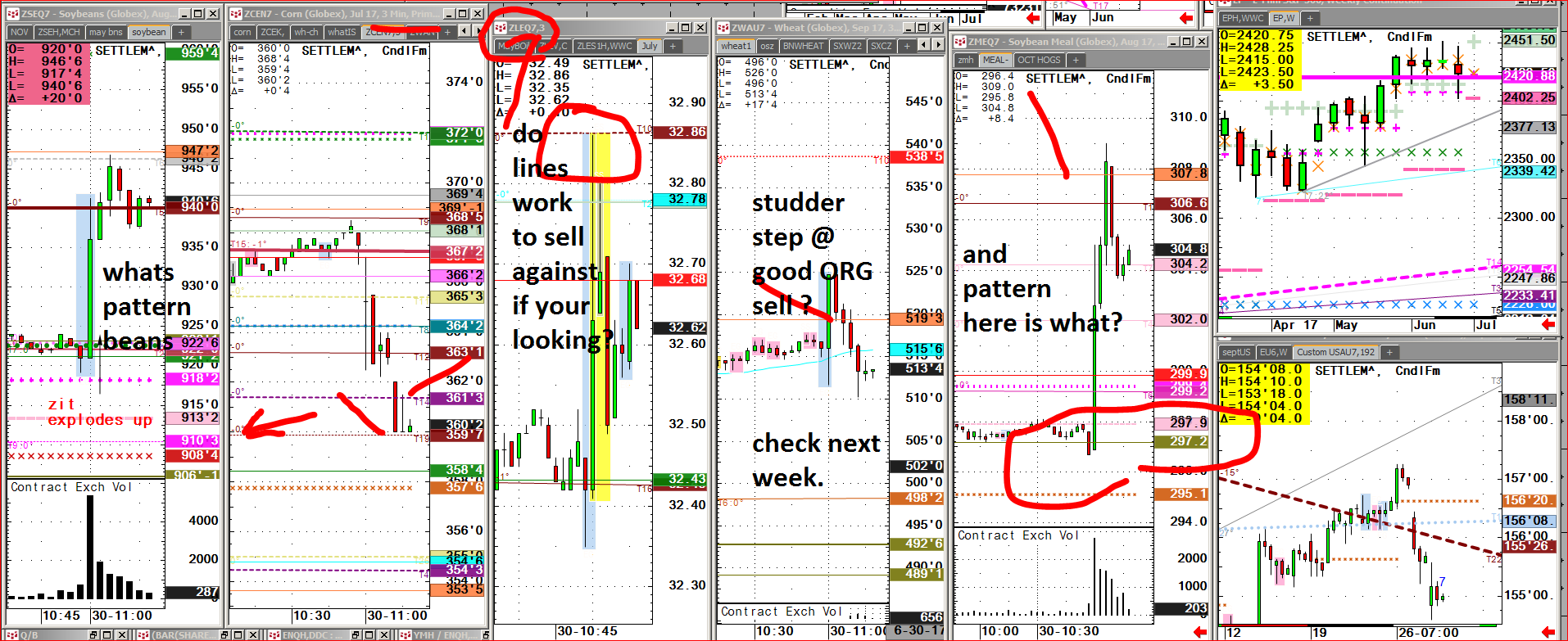

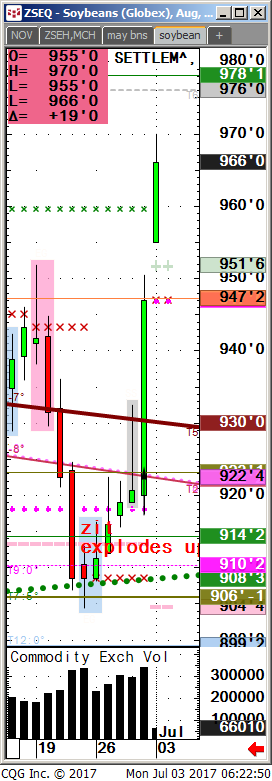

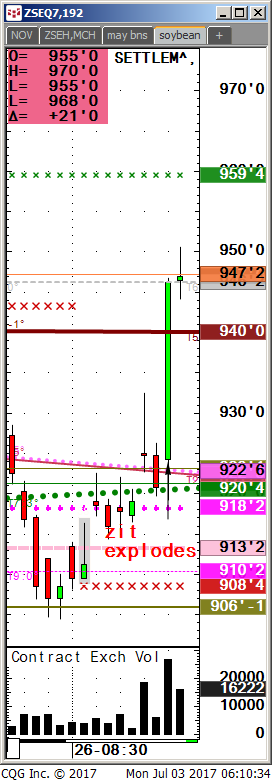

Recap here- Aug Soybeans had OLB 1st time down of $9.06 so hit&filled are the olive algo’s players. Given out for a month early. The algo that hurts the most ….

Its so funny how the crowd thought beans sub $9.00 and sold in front of. It’s like this everywhere if you need me to review but here soybeans hit the olive line before qtr-end just like others enabling you to buy and have 20cents winner before USDA which I suggested buying anyway. 9.23 was OLB#1 and a TL making it pivot into report.

Results are a 7%, 64 cent consecutive up day risk/reward situation. I call it $100 max down-strike, $3,200 seven day payoff. Maint margin under $2,000. This was an investment trade.

I think I describe these situational setups’ correct. You close your eyes and buy $9.06 Aug, SN 907 and hang on as long as your a winner. 3 cents, 5 cents, what’s your risk profile?

If you have better rule that may be. I can’t come up with what always cost me so much money right before turns. The olive line.

Now you have to hang on or pitch half, but keep the runner. $10, $12, at least your in when NY buys it all. Anything that was for sale is sold last week.

This completes ALL OLIVE BUYS now soybeans and soymeal also 297.20 was it? All buys under here in full disclosure in meal. Beans next might be 50cent lower next time down, if but I thought these were the drought play in beans for Summer so you have to stay long $9.06’s or never catch non-human decipherable rally due to tendency of swift value play that all got wrong as counter-trend move in my opinion. We’ve seen this too many times if you study it close.

I try to find very low risk areas that coincide with a huge amount of bearishness in this case. It was a great place to take off shorts also and step back on $1.50 break off those 3 monthly SP’s in winter. 10.28-ish had 3 #’s, then under 1012 nailed it. Lots of these high impact low risk levels that provide nice opportunities like 7% in 7 days.

Keep your eye on bonds, major half way failure cited cash yield, a while now. Longest of longs also, like always now a days it seems.

Best Always,

I hope the soybean $9.06 Aug, $9.07 July has not got your attention as today high a few trading days, or a week later is now $9.70. I claim this olive algorithm is a condition we wait for that reappears in all markets if you wait long enough but do occur interday or shorter term also. Characteristics are straight down which was posted with a red diamond which is consecutive down. The other trait is bearish signals that in my book are bullish at bottoms which in fact posted also.

Result- Soybeans sky rocketed up about 65 cents more than returning the margin money posted almost in full. Maintenance is under $2,000 per bean.

Here is something I wrote but did not post. I can not give market color here like I do Pro’s like, You gotta buy this pig, or you gotta believe.” This is because non pros or rookies advice may be considered hype and I want to stay away from that but here that is.

Happy 4th of July,

Any turns on holiday weekend? Look at the bean chart and think how it may look like if $9.06 SQ holds. Now look at the bean oil chart and see if that provides vision getting it back higher on the month? Just thoughts because we are well off this months low & OLB#2, —$9.06. Olive buy system takes beans long with 8.95 stop. Long term view.

The only thing I can say is you make the trade when it is there in price. Here you have a lead into the report by 20c. The olive line hurts the greatest….

Bearish report I guess all bets off maybe, but Corn did bottom $3.23 on USDA. It did bust down once after missing an OLB by a few but Is that money manager watching that again today in beans?. Under? $8.99, 2015 SP is tightest risk but long into weekend one day if it even breaks back under.

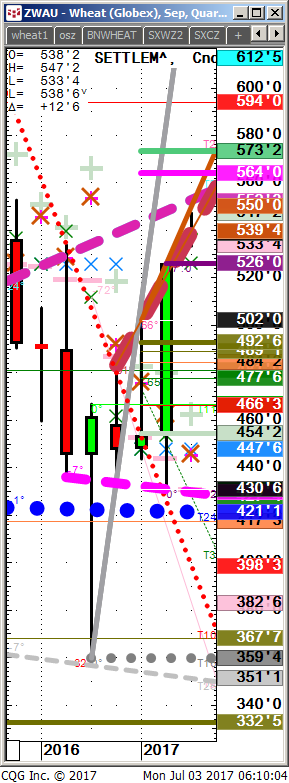

I guess they own it but I always say that at bottoms, look at wheat since Xmas eve $3.96. Huge change in ownership going on last week. NY buying.

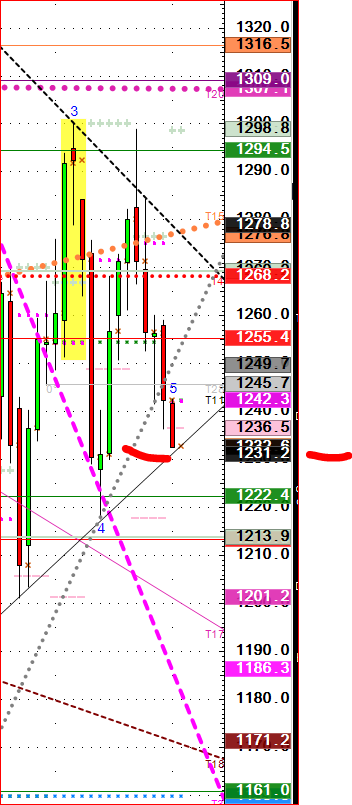

NASD- look at the pinkish line off top condition and how it played end of day and another time. Those are ones that you need to play in overnight as least risk way in as far as hopefully it only crosses thru once in o/n session. This was coming into yesterday on chart. See the condition these funds use? 5757 is line.

Recap- BON 30.87 OLB was hit&filled giving ample time. $3.96 OLB wheat on Xmas, coffee last week and beans.

Olive line has said buy out of favor inflationary for last year and half. Look at bn wheat last chart, lost over $1.00 in 10 days posting blue diamond hidden indicator once which is my default. I see everything continuing to do these extreme’s which provide a lot especially if your out of the stuff that chaps everyone up like on way down. New lows by smidge, sharp snap, new lows by smidgen then hitting a level, big bounce. It is waterboarding to longs which is a program

If you find any of this fund movement interesting I’m here to point out and take advantage of these value plays. Huge moves and bigger ones coming immediately which will change risk exponentially into Q3 end say.

Oilshare also and now above big half ways 33.80 ish. TLs in OSZ are very long term, very.

NTNX, coffee and beans all did consecutive patterns straight down hard and fast, to olive buy losing 5% to 10% on these orchestrated, selling conditional, spike downs that provide value a few ways. Crude missed by 30cents at 41.77 this last $9.00 break was it?

I think this olive line is the nerve of trading. watch USDA after the #. It’s worked on fed days. SXWZ on bottom and posting blue diamonds, 10 in row lower highs to downside . A bnwheat from Jan 17 also enclosed, $2.40 high at time and 30c over an OLS $2.14. This is 1 s- 2wheat, now $1.24 NEGATIVE beans under in 6 measly months. Can you imagine if you could trade like this? A few trades a year? I think GS customers do and that makes it pretty simple. We just need that pocketbook.

Major lows are in all commodities now, under $9.00 then ask but this is really perfect in front of the 4th of July and the start of a 1983 type drought. Should that be a question? Lol.

I put out daily voice wrap ups on walshtrading.com.

Best of Trading,

Al Palmer

BUY THE OLIVE LINE AT $9.06 1/8, LONG TERM, MUST KEEP WINNER BECAUSE CAN TURN INTO BIGGER WINNER BEYOND EXPECTATION. DID THIS HAPPEN?

170630_113629_USDA_ZSEQ7_-_SoybeansAug_17__qtrlyRPT NEAR MISS AT 909 WAS SHORTS COVERING. PRICE ACTION WAS WATER-BOARD-OF-TRADING down to 9.06. It has to print.

A few perspectives but I tell traders to fade my olives if they feel lucky.

A few perspectives but I tell traders to fade my olives if they feel lucky.

corn-w-usda-off-SQ-OLB906

Last year as wheat got decimated you know where we went to. The number that hurts the most traders. $3.67 was a falling knife nice level. Investing in wheat was same as crude theme and now beans and coffee but others also.

Last year as wheat got decimated you know where we went to. The number that hurts the most traders. $3.67 was a falling knife nice level. Investing in wheat was same as crude theme and now beans and coffee but others also.

Do you have any interest in diversifying with high impact trading moves that look for returns of what we post as margin? Shoot for the moon, miss and hit a bird instead of shoot for a bird, miss, and hit a rock.