ARP HERE, All Opinions,News, Items of the day as I see them. MEATS FCX held a green algo, The first time down at last weeks low,place a stop below the low level. The cash traded 114,then 115 in kc I suggest not looking at the fundamentals,and play the olive line levels with stops. This can be difficult. CME pit talk …

Livestock Report – Live Cattle

December Live Cattle struggled on Monday, October 29, 2018. With cash trading as high as 115.00 on Friday, traders were hoping for price to challenge the higher end of the trading range. When it couldn’t trade above the Friday 118.80 high, sellers were able to put pressure on price. It couldn’t take advantage of Friday’s strong trade in both the …

AG TIME – Rolling Along

The month of October is about in the books. The weather has improved and the harvest is rolling along. Today’s progress numbers should confirm that. The next large fundamental to watch will be the Nov crop report. It is possible to see a further increase in yield. Slight as it may be. The beans will continue to have much to …

Don’t Try to Find The Bottom, But Try to Buy the Dip

MACRO BACKDROP: Welcome back, readers. Domestic equities markets have been posting negative closes nearly all month. Losses have appeared broad and wide across nearly all sectors. Selling has been rampant, obviously. In the underlying S& P 500, defensive sectors appear to be the only sectors with gains as scared money may have found a place to hide, in my view. …

Crude Oil Strategy

Crude Oil fundamentals are pointing lower in my opinion, the Hurricane season is close to ending. Gulf platforms are back online, shale production remains strong, and data from the EIA per yesterday’s gov’t data is showing strong builds of crude oil. Also providing stability to the oil outlook in my view is both OPEC and non OPEC areas possibly promising …

Livestock Report – Live Cattle

December Live Cattle recovered from Thursday’s loss on Friday, October 26, 2018. It formed a bullish outside candle as it traded back into the upper part of its 116.025 to 119.75 trading range. It made its high for the day at 118.80 and settled nearby at 118.40. Futures started the day on a weak note, opening below Thursday’s settlement and …

Grain Spreads: Wheat’s Revenge

It was getting ugly in the wheat complex with spec longs among others getting run out well below 5.00 amid yesterday’s rout. Both KC and Chicago contracts were staring at the 4.60 level should we have fallen hard below the last bastions of key support at 4.87 (Chicago) and 4.82 (KC). We have been bemoaning the lack of demand for …

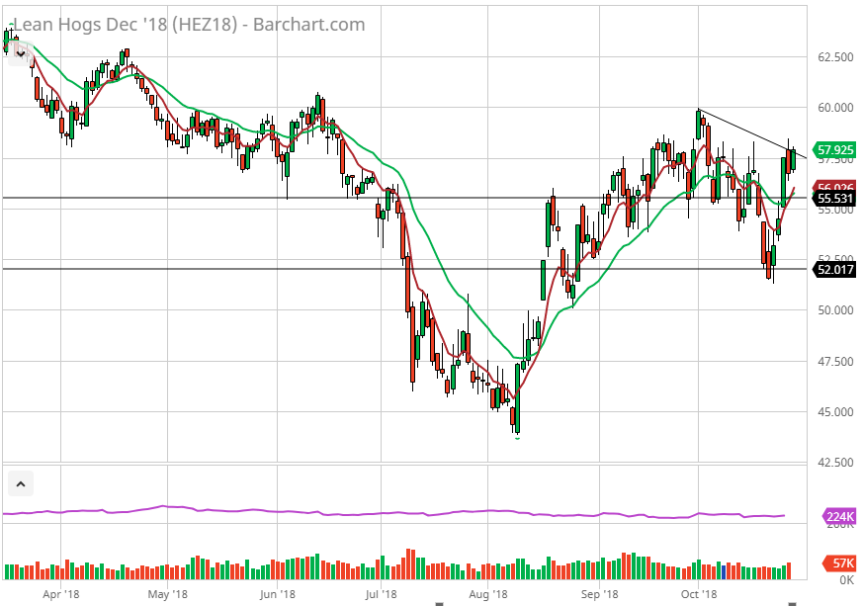

Lean Hog Call Strategy

Hog option strategy. In my opinion, I think Hogs will strengthen further, I am looking at Call option strategies with Put hedge’s. Hogs are highlighted from swine fever, from the world’s largest producer China, with Europe and Russia having the same issue, the Chinese head counts being culled by some 300,000 also Russia and Europe having to do the same. …

AG TIME – Crush it All

The markets are rebounding today led by meal. It is my belief we are potentially on the verge of a large shift in the oilseeds in general. The slow down in Chinese imports is a large story. The ramifications larger. The demand growth for beans and consequentially meal has been unprecedented year after year. This is stalled. Actually predicted to …

Nasd FANGS buckle, Egypt Wheat?

ARP HERE, ALL OPINIONS,ESTIMATES,NEWS,THAT I PERCEIVE MOVE THE MARKET. I have talked for some time in my posts that stocks are overvalued. It is my belief the NASDAQ PE is silly high. My goal is to assist you in these extreme levels through the Olive Line. In my approx 40 years of charting and trading the markets, these may become …