Good Morning,

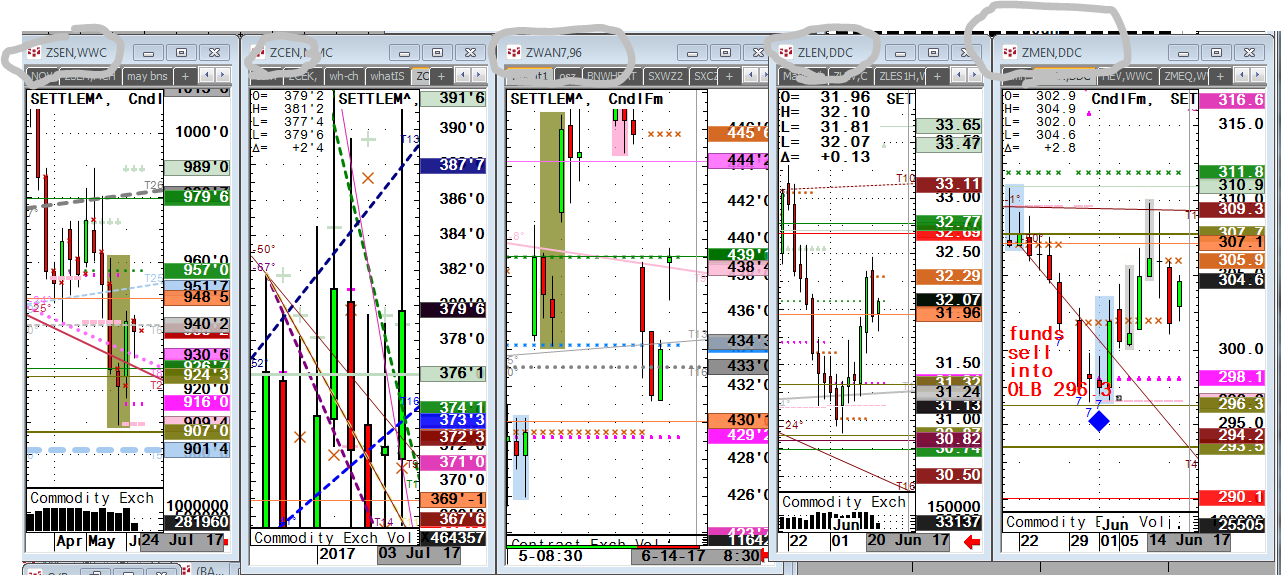

As we approach qtr end #2 17′ we see back and forth immediate turns in grains based off my macro trend lines in the Ag’s. Algo’s play these if you look, hashed are longer term and for that type trader. Day trader’s- over line, you buy go home flat but rules here also.

trend lines in the Ag’s. Algo’s play these if you look, hashed are longer term and for that type trader. Day trader’s- over line, you buy go home flat but rules here also.

Long term- Buy this break again but respect levels as mkt tends to find last big stop loss orders. Watch $9.07 possible hook strategy trade.

Bean corn ratio up by possible top, bean wheat opposite was yesterday and recent low.

Federal Reserve- They hike, stocks explode up? Higher interest rates cause higher inflation.

Watch levels into FED FRB rate hike. I expect extreme’s most likely before. HFT will be seeking stops

10 year Treasury Auction – Hang on folks. this is when it heats up. Can I say that? Santelli is the one to watch.

Expect some vertical fast movements so get open order entry ready on small quantity to use as remember, you’ll see. Write my levels down in your specific market. Longer term charts more macro of course. Also why displayed.

Crude- this is make of break. It could be bottom, could go once again but if back over stated above events? Let’s talk your market.

Meats cited before topped is opinion, olive cited, one or two day heat, meats are sloppy but darn close here.

Favor Buy Inflation Now. Macro into Grain highs in Qtr 3 is lean. Too many individual stories live daily. Ask for buy levels only. Let me save you on sloop? Look a meal blue diamond pre-programmed on my CQG software. I think the best. If you have? It can look just like these.

Current Issues- Banksters, Central Bank Control, Germany Schwabe guy, must must listen, whoa on implications if that happens. Get a trading game plan Expert.

Gold, buy sharp break into Fed, get a level. Lines have played well last 9 months previously on NASDOG.com, a paid research trading site, now mothballed. Search bar is v good.

Hang on because I see big trading opportunities but you need hard and fast rules,

pre NASD100- Fed rate hike. what can hold stocks down anymore? Do not be surprised if blow off higher continues. Sideline money still moving in stocks. Handful of stocks most of index gains, frothy but beware to bears.

and must stay with winners because when they turn like crude, pattern ensues but trading idea methods need to be sound. Below is my Christmas employee Silver Cup which is a cherished time a life time ago. This is the real deal and I find the next trade. arp.

I am out for a long weekend so pay attention to your risk.

ARP@walshtrading.com

312.957.8248