Calm before Storm

Next 10 days is now time to have alternative strategies and appropriate risk parameters always or you will get carried out and yes, the partner may get involved.

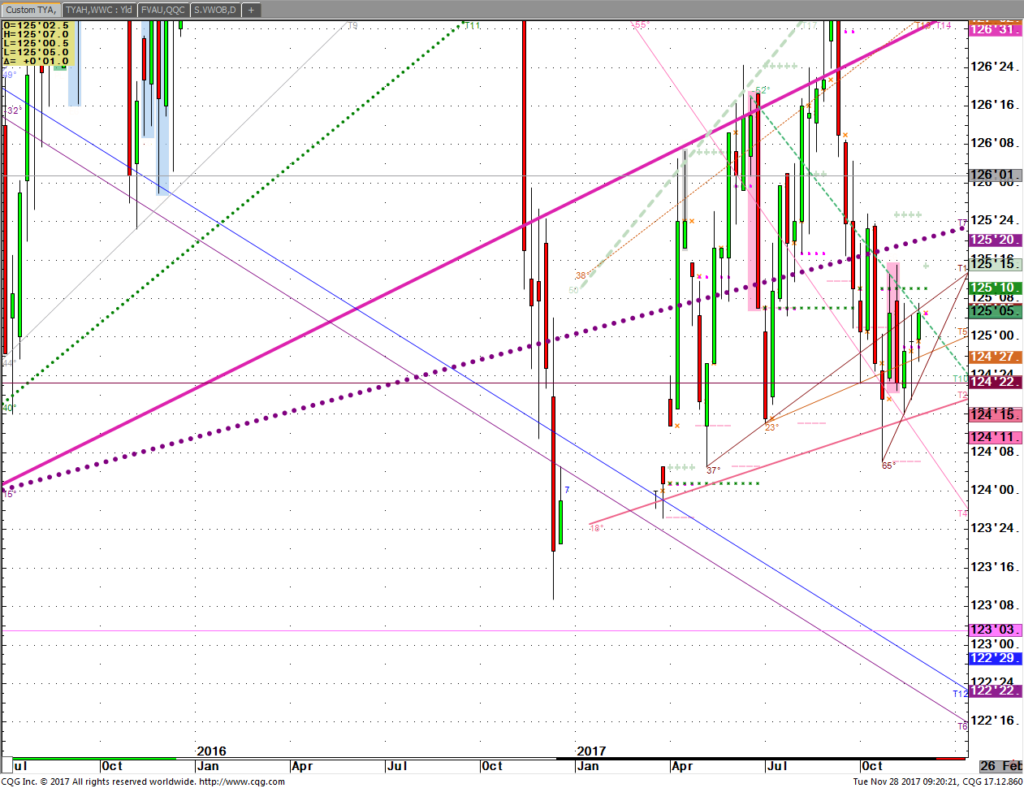

US default deal looms? People tell me I’m nuts, risk is as real as it gets, next few weeks.

Markets can be subject to violent turns upon recognition of macro events.

Oilshare- long beanoil short meal and rarely talked about by commentators. Risk- always expect unexpected (greatest grain floor trader’s rule collection).

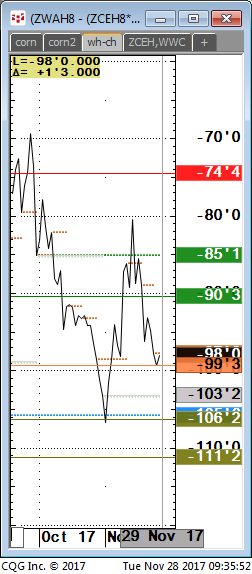

Lets talk about major macro moves in OS. This spread split OLs over 36 or even 37 and pounces vert down to 34-ish with overnight stiff rallies described as only for big boy traders, trading desk pro ratio product.

So now meal has rallied 295 (near miss) to 335 on China buy meal news. This is a change of facts. Right? Same time India rumor increased oil tax. Both bearish unseen inputs that tanked OSZ after last weeks 59+ tick, $1500 bounce, OLB and more support areas under.

This is a momentum laced fast moving spread that leaves no prisoners.

This am early OSH up 50 ticks which is another grain trader rule from my collection from the best of old trader lore.

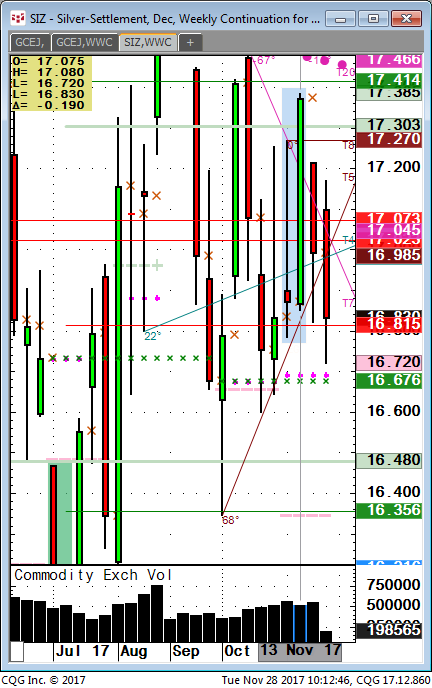

Silver apex 16.985- 17.04 finally got whacked on this double fakeout in silver last few weeks.

Run for cover so you can buy it again, lower when events occur.

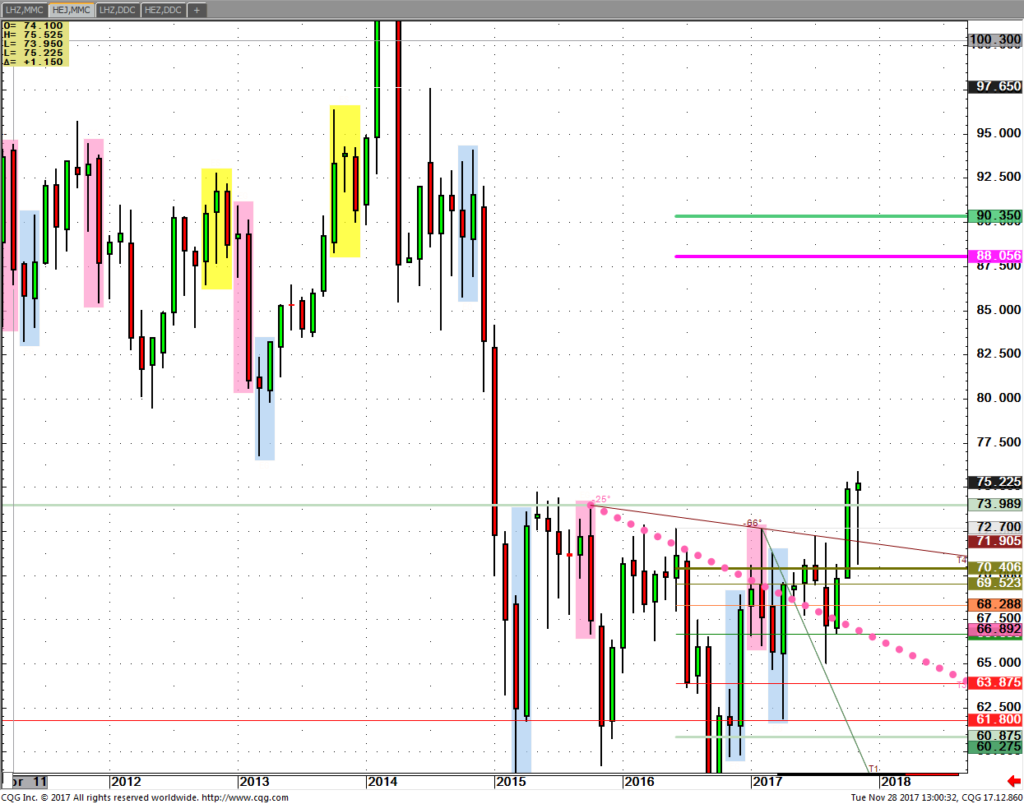

Meats-you either bought that chaos panic day last week or take a pass. Risk approach with .50c clean stops FC 150, LC 117 were rare setups. Then you accept overnight risk from those points and let it ride. It’s hard of course but only rule I could come up with objective, to catch vertical moves. Those green lines posted that day do have tendency to take out highs which looks like chance in hogs and cattle a week behind. Now shoe in, with today’s late high.

If China is taking all US crops then in general we should get price inflation. Fed is rooting for it as the code to insiders? You better have a 2nd account if you don’t recognize that event. I think its coming and next 10-30 days are in play as for as this market color.

Being early can cost you.

US Retail Sector stocks getting crushed daily. I saw this a decade ago because tax free tech industry goes for biggest money 1st, the trading community in Chicago went from 15,000 to about 300 in less than 10 years.

Workforce participation is 62% low tick, its bumped up smidge but it’s going a lot lower but that’s a standard of living issue not for here.

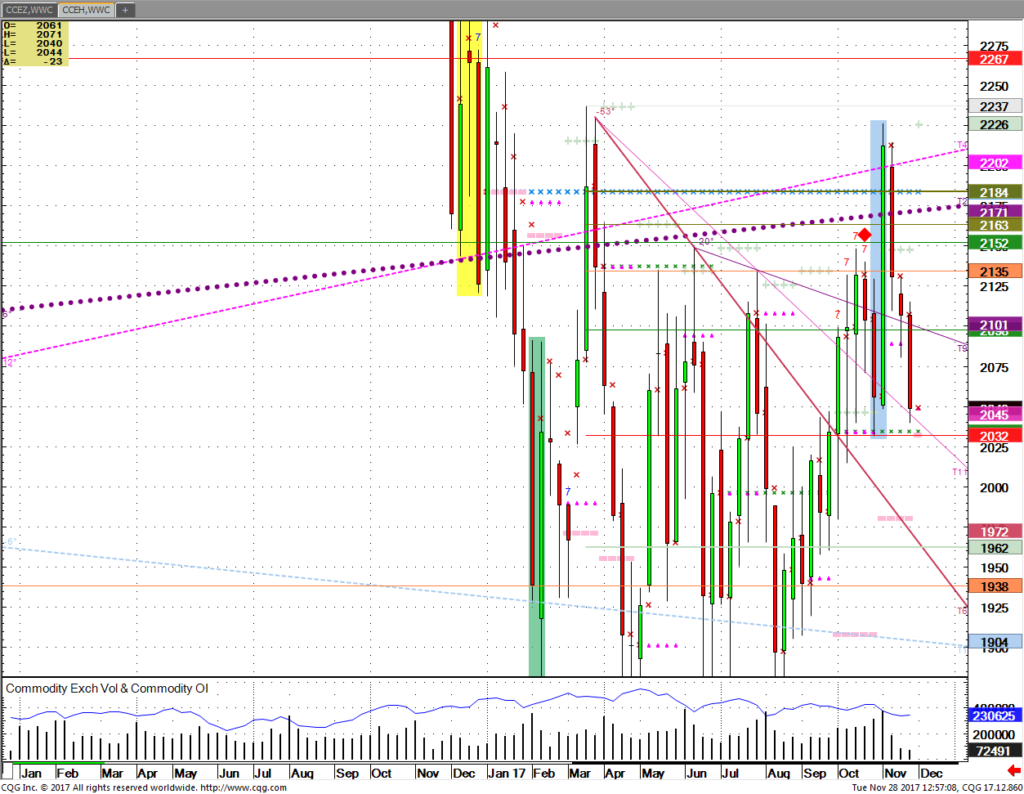

Employee-less companies! Is that bullish or bearish for the price of the stock? How about tax credits to put humans out of work? NASD has hit something at the high today. The last 4% was fast.

Always early can be as costly as being late. Always use a stop so you stay in the game. New Bitcoin kids I have heard twice today from traders in Chicago have told me bubble type attitudes by longs. Stick an order to buy at $1,100, open order.

Sign Up Now next webinar Wed.s or let’s get started now

https://portal.straitsfinancial.com/user/register.aspx?brokerid=268

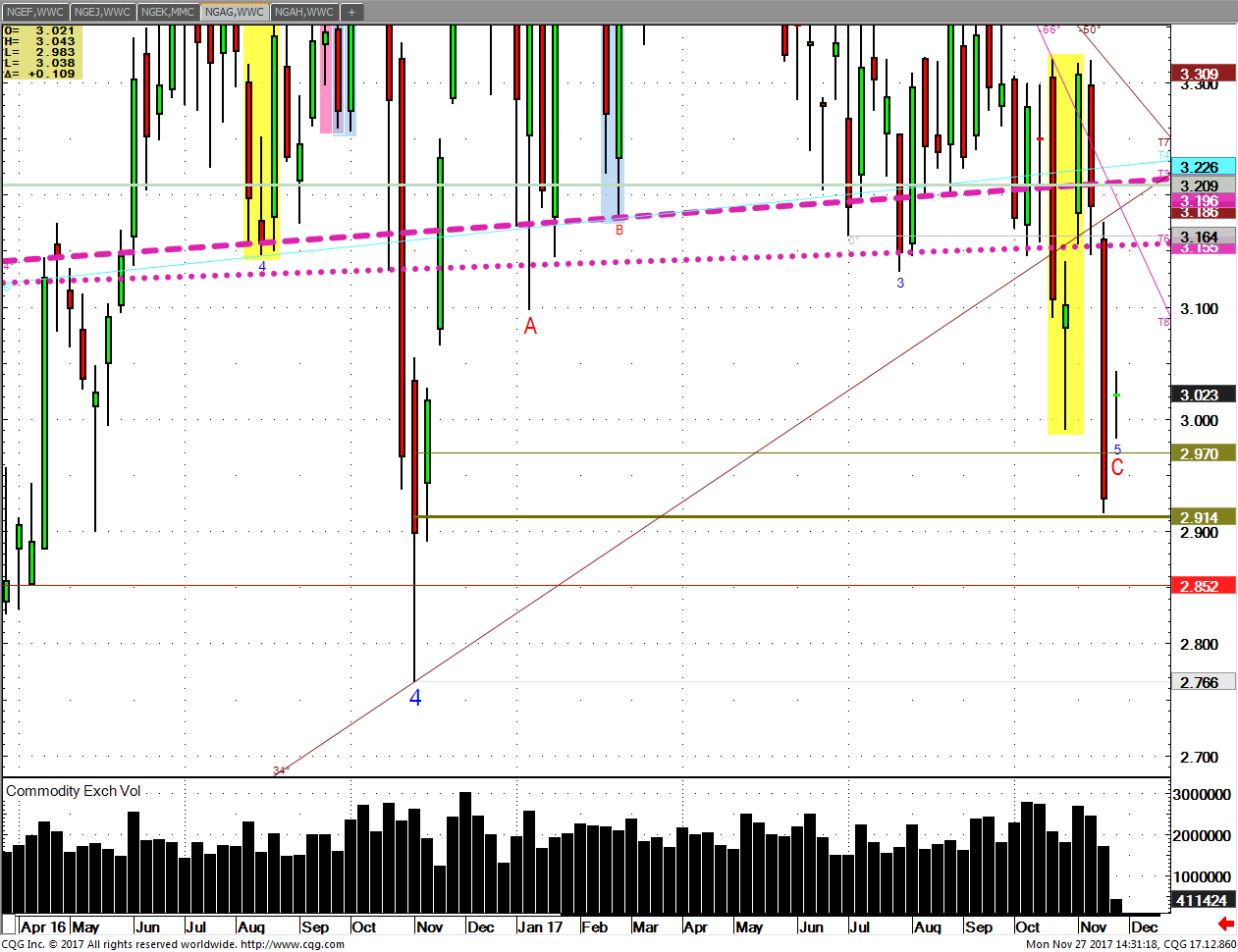

Gentlemen, The charts are my artwork along with the patterns and lines. I really don’t post some of the more revealing charts because I think people might figure some of these out. I am more than happy to share these with clients but as I skip over a few in adding here I give you my word this is some pretty darn good stuff. Heating oil in one month has hit an olive sell worth paying attention to while back months, and spot have not triggered yet. The last two years has really put some of these patterns like meats straight down and now pretty much straight up has us within knocking distance from the old highs. Buckle up because once this unwind starts it is going to get busier than we have seen in the last few years. When someone gives me a ratio inter meat spread and my olive was the high. I think I have something different for clients.

The time for a 2nd account might take serious consideration. Check out the hog charts, all different months, time frame but all the same patterns. Someone just bought hogs in April on this 3rd red diamond if looking to fade. You know by now, new high stop and stay fresh.

ARP