Good Wednesday

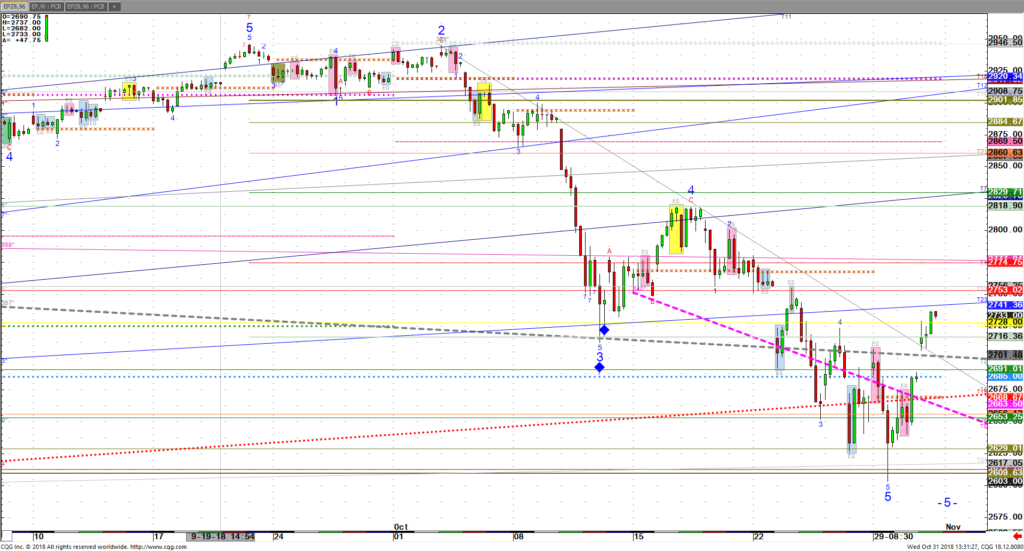

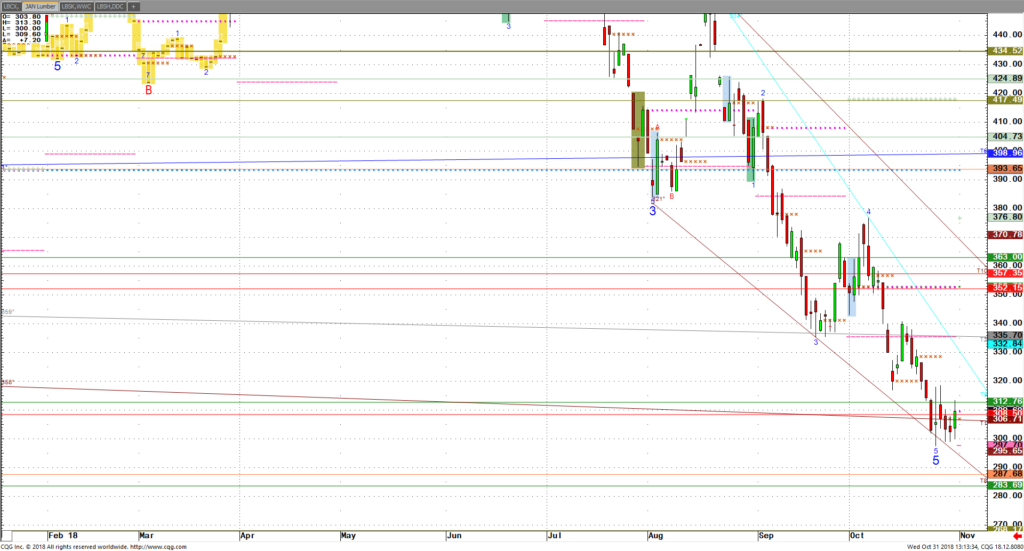

A review of the recent 5% swings perhaps.

ALERT – S and P’s, Dow, and Nasdaq all have hit my olive line extremes.

1 st Time Down. This is my condition live.

Does the stock complex bounce back to the highs in late December.

If you were waiting to buy monday, when the depth of TV hype was happening.

We hit olive Line Buy Levels.

** DISCLAIMER ALERT ** This can be like catching a falling knife, You must Use stops in these markets

This Volatility can create risk and opportunity. As I have said I believe that we will witness

many extreme moves in the near and longer term. give me a call for specific levels.

It appears the lows could be in,I am off the bearish outlook.

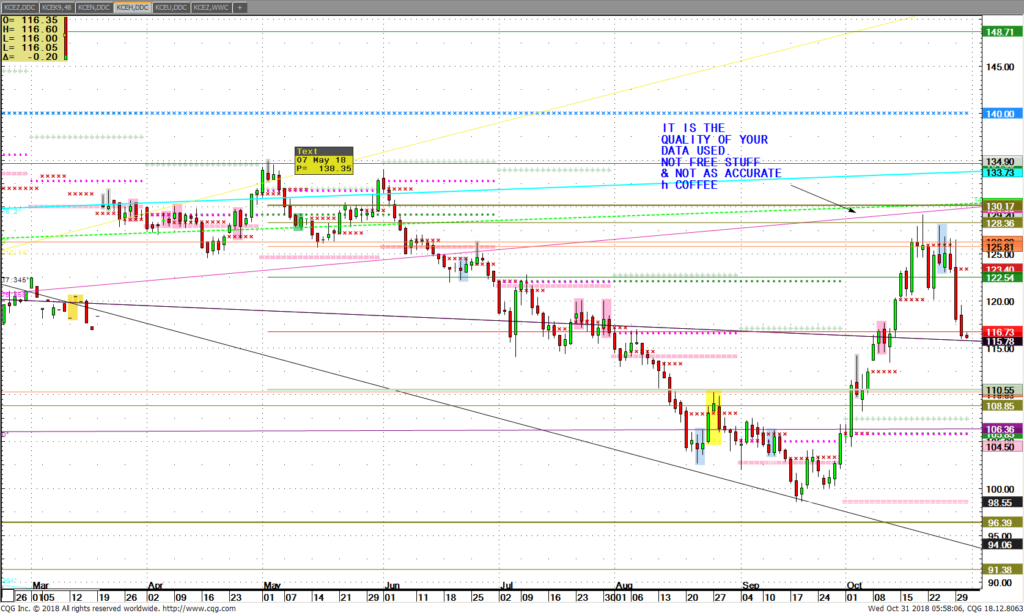

GRAINS

KC WHEAT is on high alert. looking for a buy

Soybeans – I am looking for OLB with a tight 2 cent risk stop

Lessons

Do you want to trade off of well constructed lines ?

Do you use stops to protect your risk capital ?

It is important to know our place in this business, humility.

Have you considered day trading instead of long term trading ?

I suggest to customers as we build a relationship so you know where the levels are solid enough to use stops.

Please review the Olive Line signals from monday. When the Chaotic Algo Timeframes are hitting,that is where the Olive Line may assist.

When I traded on the floor I felt best and traded my best when I would go home flat.You can move quickly the next day.

When you come in the day flat like the flat algos I study, You come in Fresh.

I dont want you to need to defend a loosing position.

Think about coming on board and give the Olive Line a opportunity.

Best Of Trading

ARP

Below were olive line buys sent to clients early that were looking to buy stocks. See chart.