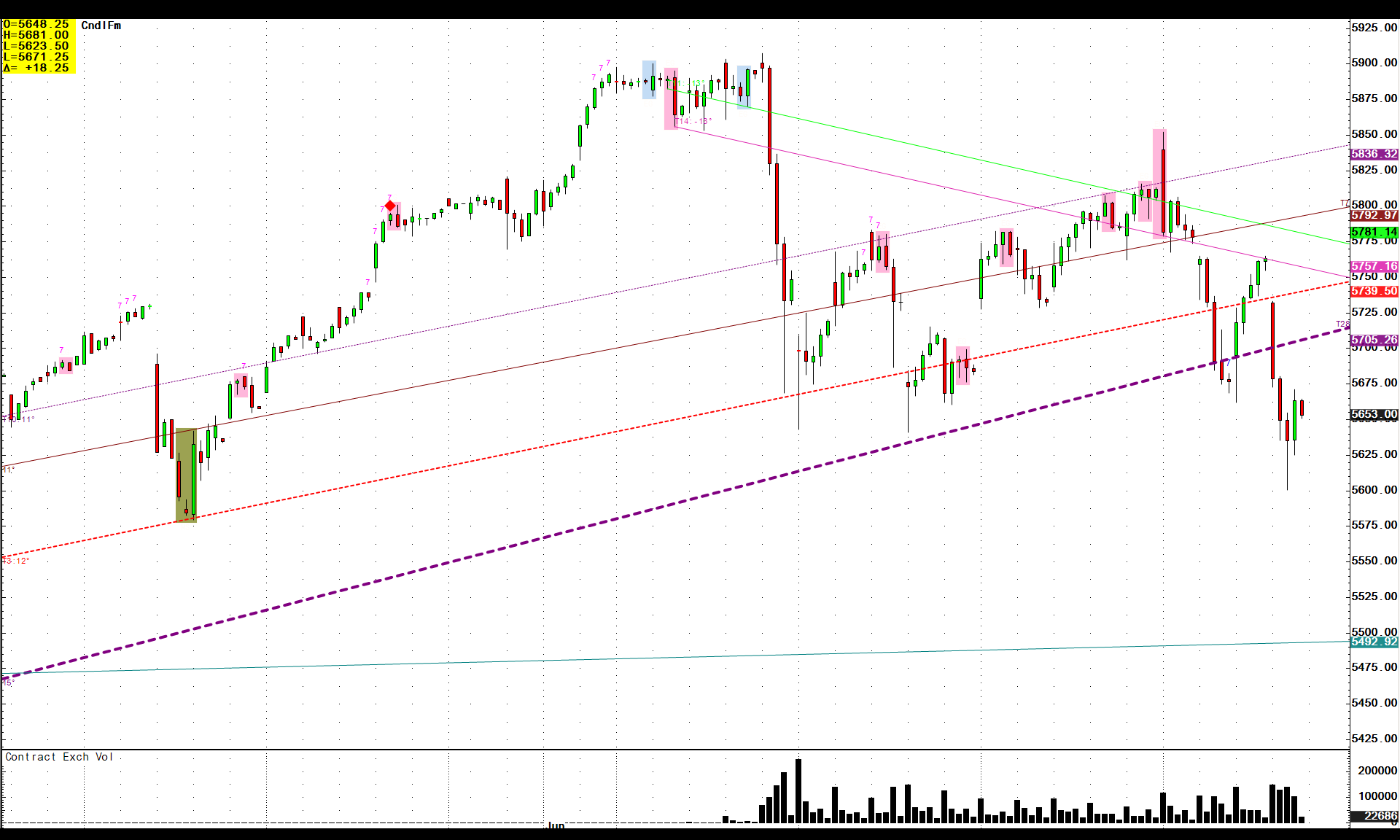

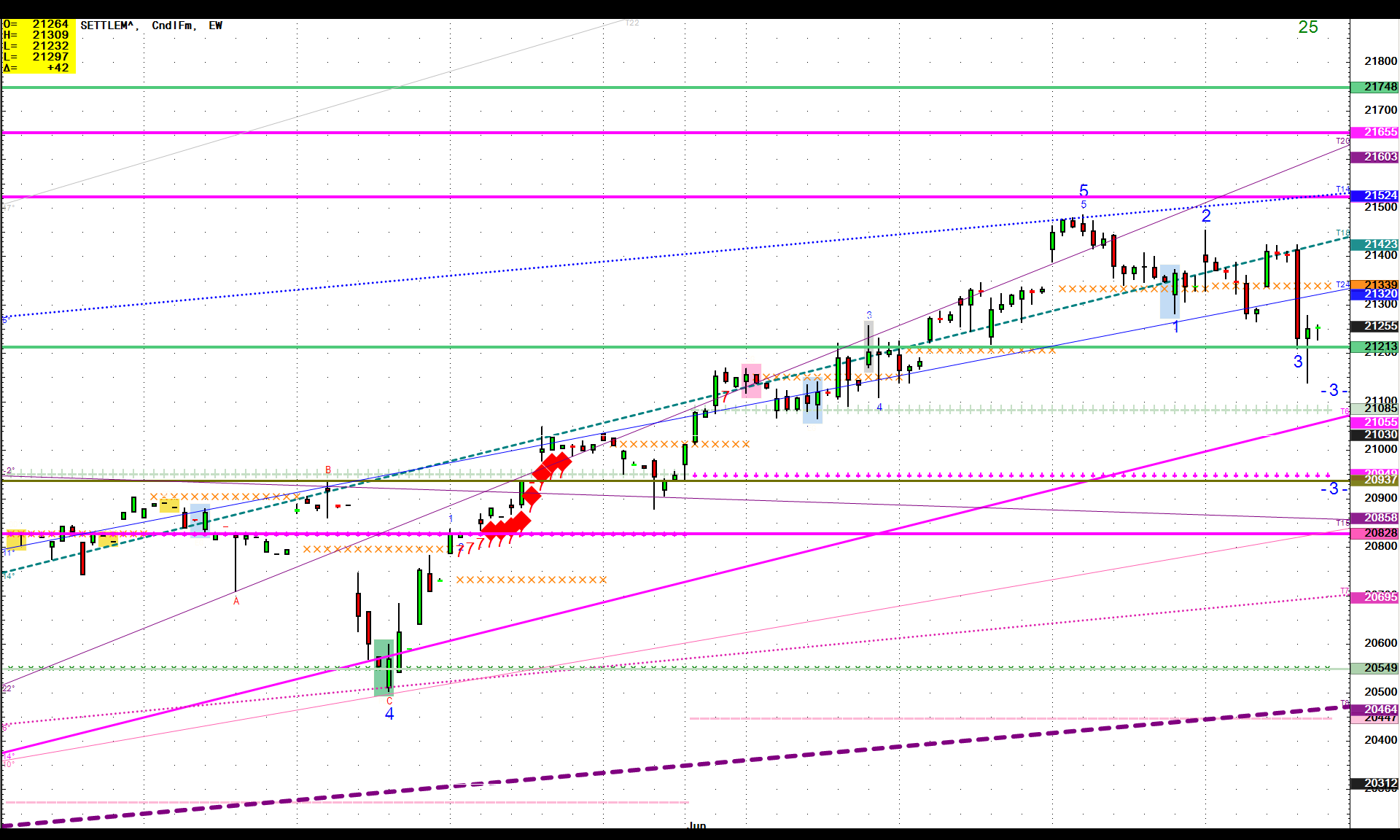

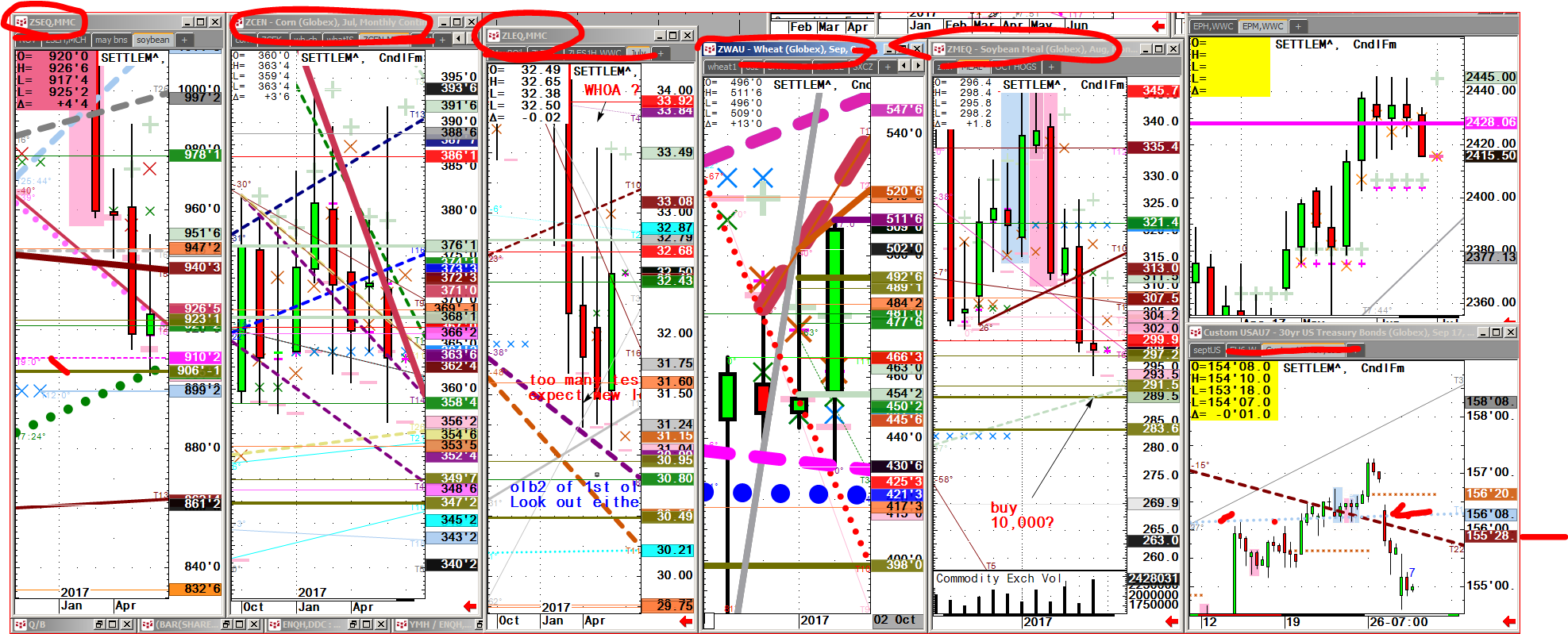

ASSET ALLOCATION TAKING PLACE HEAVILY NOW commodities and stocks, nasd spreads etc. Major trades are everywhere. Long coffee and soybeans have been hit, meats also, stops under of course. This is Pro Trader talk.

You want to be a Pro don’t you?

Pick a number on chart if you feel lucky, or call me. Buy volatility now in AG specific bet laid out last month. 1015 AM ISH

Cattle and feeders hit long term solid sells in May. If ever over buy it but otherwise this is a recent olive buy bottom in charts prev posted and trades you should have taken advantage of.. Feeders ditto, see prev levels in chart. Olive colored have specific proprietary trading rules from scalping to long term using slightly different timeframes.

HOW TO READ CHARTS- – – below is how a client of mine of two full years in a rural corner of a mid-west state east has adapted a real trading approach using what I mentored a VIP before Walsh on NASDOG. He caught coffee one or both of the last 2 years. I’m impressed and maybe this might fit you and coming to trade through me at Walsh.

Charts on bottom, go back after USDA and study how computers slap markets around and their (proprietary) rules WE USE to take small bets, (SQ buy $9.06-08 hit/filled, low tick 9.04, <$150 so far, stop under 895. or 897. or 10 cents risk. I use tighter but am a short term floor trader to advise you long term. I can say what’s going to happen across board. Nobody can trade everything. Let’s get long the olive. Best ARP.

———————————————————————-

Hey Joe,

Here is a heating oil. I don’t see too much but that is your product. Let me know what else your looking at so I can shoot you off something. You hit that coffee last week? Man that was sloppy but boy the heat ended within a few hours.

Anytime you want to chat, I’m chatty, lol, snicker.

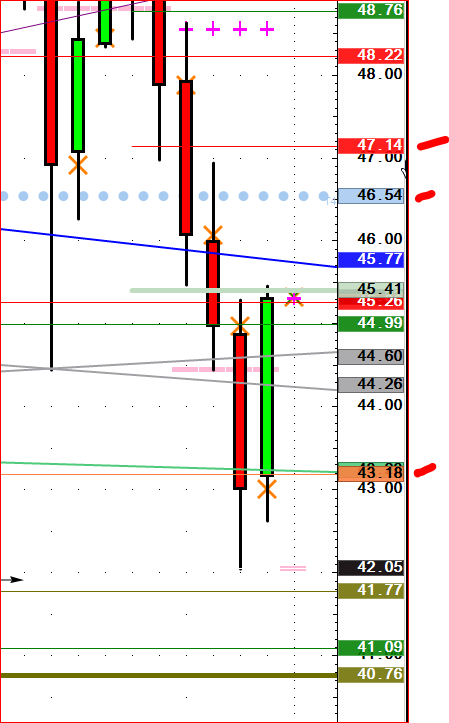

THIS $9,00 OR 20% FAST BREAK IN CRUDE TOLD ME TO BUY AT OLIVE 41.77. I will find you opportunity on major moves that present themselves in what ever product you want to trade. I am here with trader trading ideas and good low risk high impact levels we shoot like a son of a gun. Don’t Gamble, trade futures with ARP @ WT.

ITS ALL ABOUT MY LINES. SEE PINK KISS,

next day is good pivot on this 300 handle break, $6k a mini ? Lets trade these. You can do it but thru me. Dont worry about commiss. look at the quality of this artwork you need to learn.

IF ANYTHING LOOK LIKE YOU COULD MAKE MONEY LET’S CHAT NOW.

WHAT IS THIS THAT WENT OFF IN YOUR CHART AFTER $3.00 BREAK IN 6 MONTHS BEANS GETTING CRUSHED RELATIVE TO WHEAT? OFF OLIVE SELL TWO QTRS AGO?

IF ANYTHING LOOK LIKE YOU COULD MAKE MONEY LET’S CHAT NOW. PERSPECTIVE IS HOW I WILL HELP AS YOUR BROKER. 2 QTRs down? What do you do for example. Macro big picture I excel at is John Walsh take. I just have never been able to trade seldom. It’s good long term. See old cite when wheat or corn last 2 years. I advise caution as disclaimer but rules I teach you can use. Convinced yet?

gg