In my view

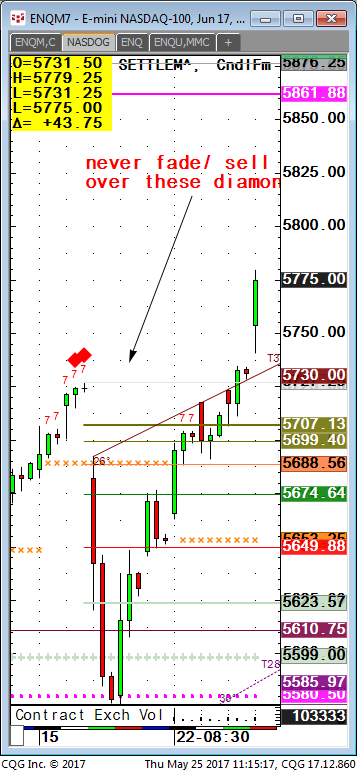

Stock bubble now in force, 1987 anybody? Aug 26th was it?

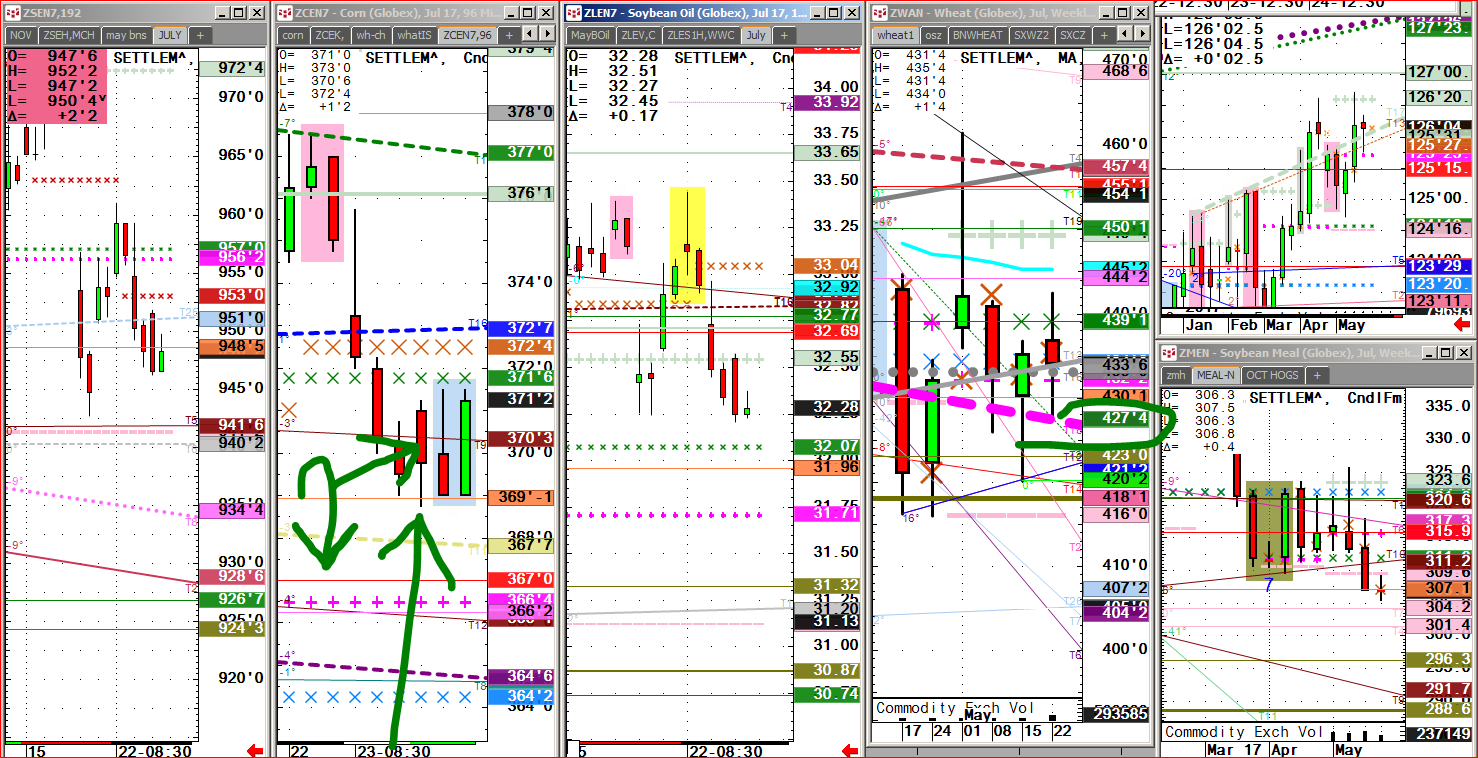

Soybeans last few days had some fund guys trying to hold up this pig that is showing its true colors today, auto pilot selling next few days. Meal also. My timed interday meal (the way they hide it from you) has just gapped down explicitly when one bar ended, next starts. I’ve seen this dozens of times so it looks like payday for short bets. Buy stops now over $9.51, my other #.

Wheat-? Buy wheat sell beans. It feels like we break until end-June to me if your looking for an idea, flippant?

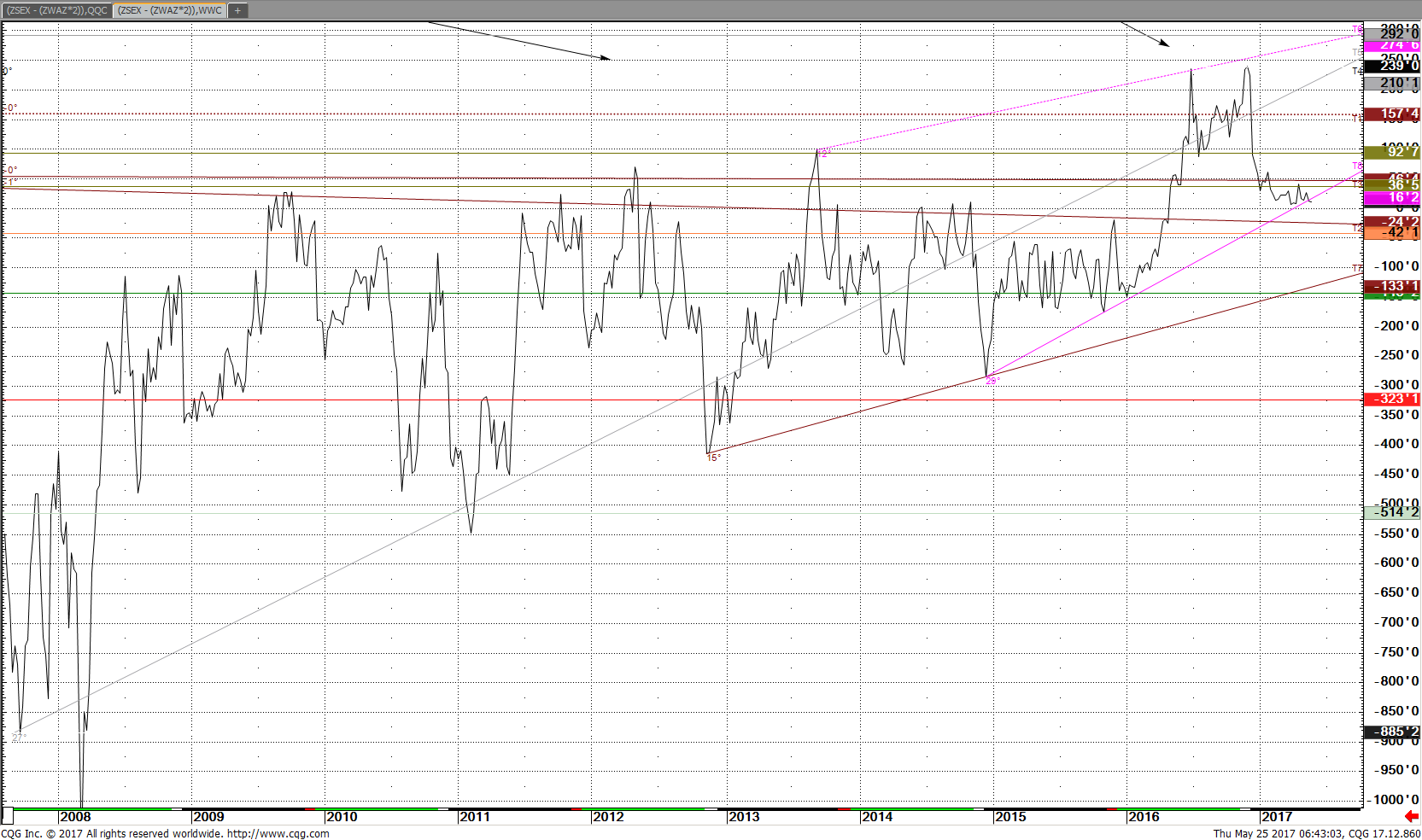

Below has been a chart sent to associate Pro’s over last few month’s. meats on bottom

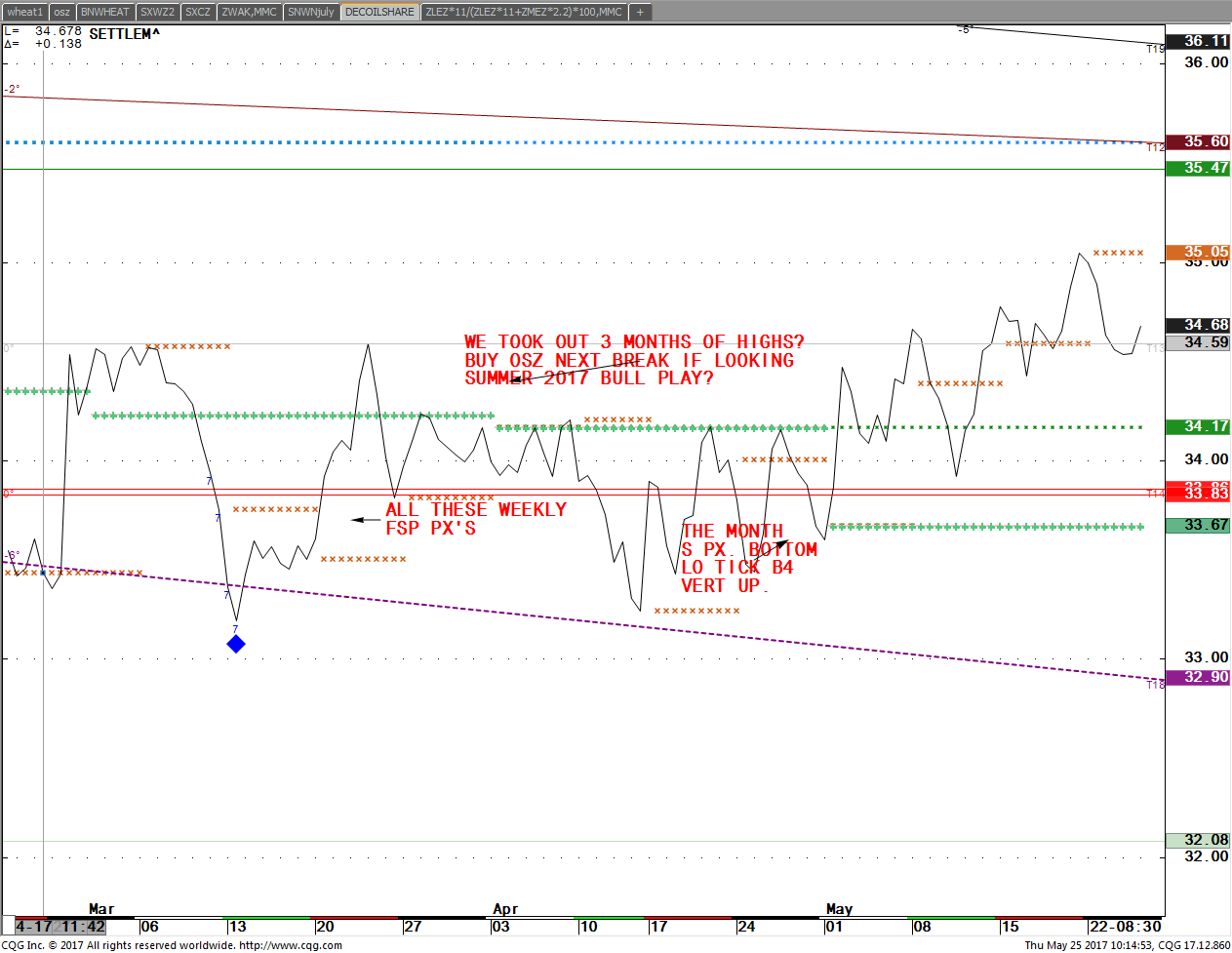

The labels from this chart are from another computer and have been the OS chart I prev sent to Pro trader’s. Value is these idea’s I throw out but never where able to trade this long term. You may consider that I have always been early. (trader story).

Oilshare drags higher because meal will be the pig. poop.

Are Farmers concerned that it seems everyone wants to help out oil producers with higher crude oil? I thought it was a major cost for you guys.

Now this am in Chicago I write this comment but see how powerful the 307.1 in meal is?

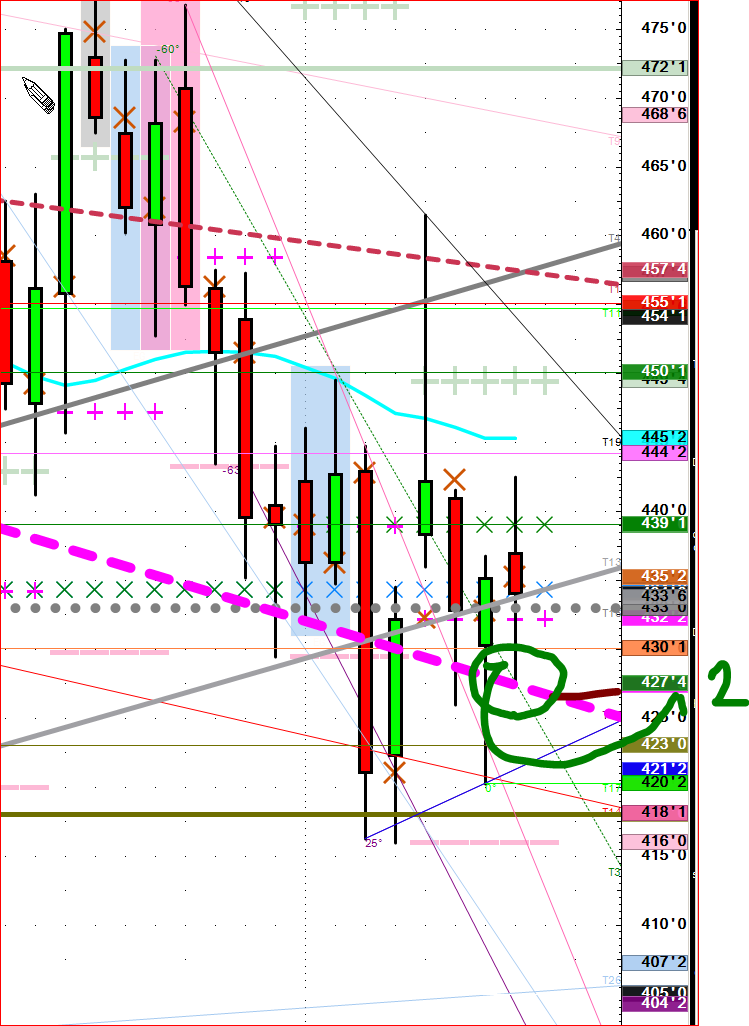

The wheat line, has two macro trendlines

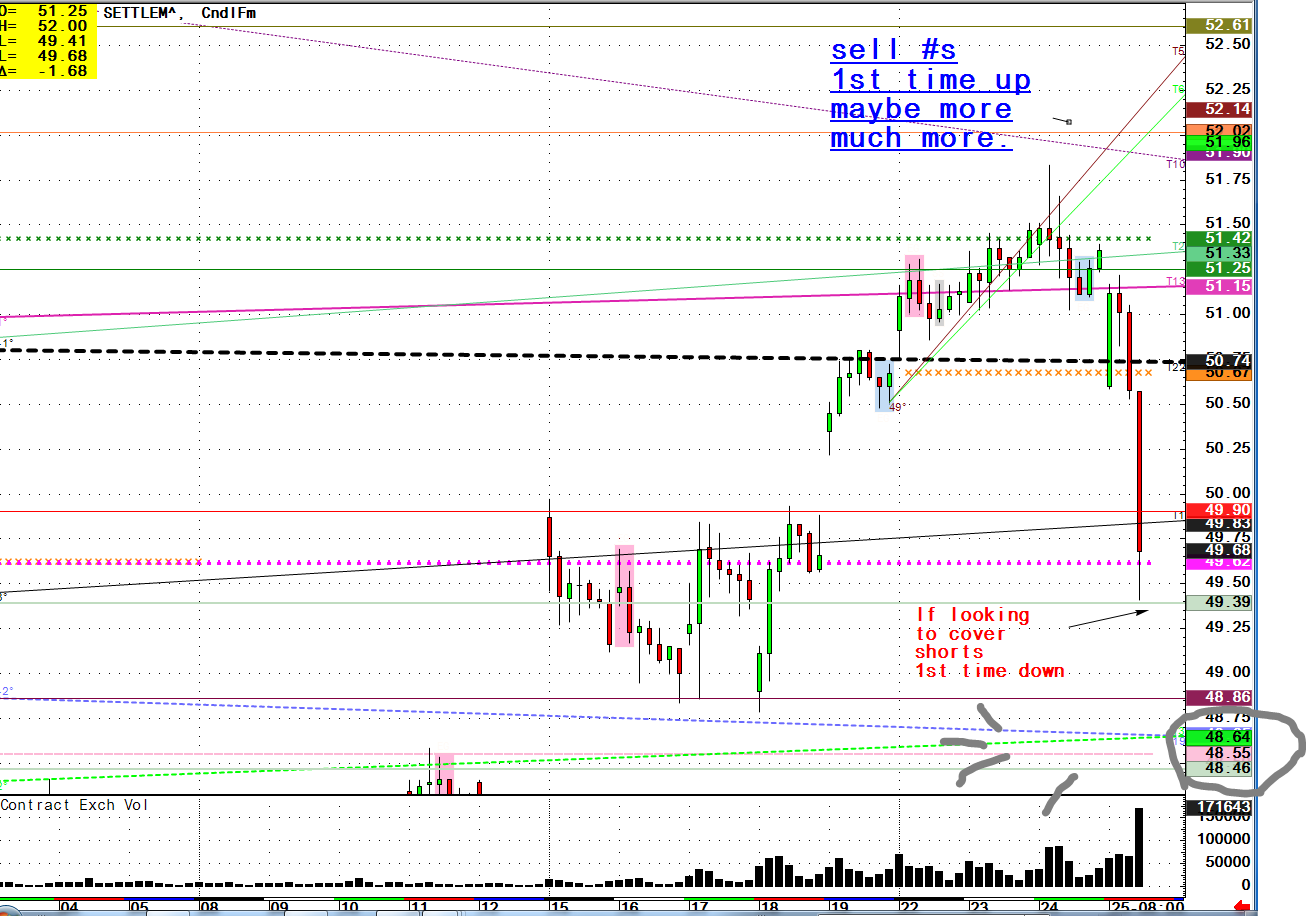

48.75 ish has a whopping 6 #’s stuck in tiny range. This mkt will respect these, if they don’t, look out below but this is far away as per chart so a long shot, or place to cover shorts.

Flippant comment about weather- This is shaping up as a possible drought year. I also think beans go straight down until it starts which is eons to day traders. It was my 1st drought I traded a lifetime ago. What is it?

Wheat kisses those 427 lines, Look closely, this is not goofing around. There are two lines which mean powerful.

This is where you can buy 200 wheat, risk 3/4 of a cent risk stop.

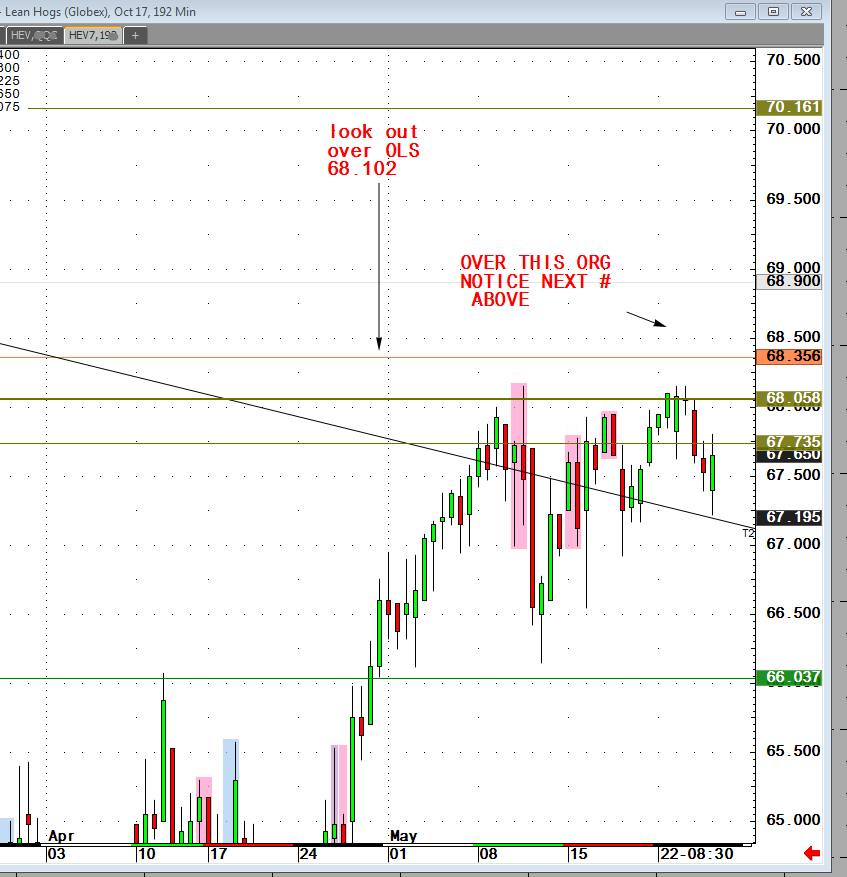

here is an example of what I call an olive liine sell, OLS2 VIO, and we can easily go up to the 1st target at top of chart

here is an example of what I call an olive liine sell, OLS2 VIO, and we can easily go up to the 1st target at top of chart

Do not sell short over red diamonds here is my trader rule macro speaking.

Crude is falling apart. If you my client, need a level. This is what I have to offer you.

ARP

h

h