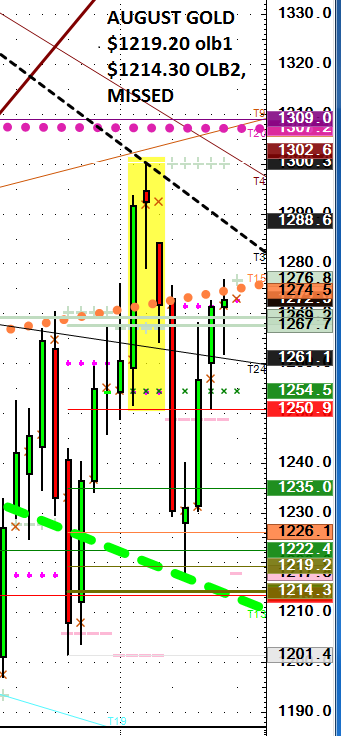

Aug  gold- late add so I put on this page from mid morning. I think once thie US dollar starts sloshing, like today down 3% it may unleash markets we have not seen in decades. Macro speaking bu don’t rush to sell Bonds as crosscurrents too many to list. Gold now has to get over this 1288 black trendline to light this market higher in my view.

gold- late add so I put on this page from mid morning. I think once thie US dollar starts sloshing, like today down 3% it may unleash markets we have not seen in decades. Macro speaking bu don’t rush to sell Bonds as crosscurrents too many to list. Gold now has to get over this 1288 black trendline to light this market higher in my view.

Expect bigger ranges going into Summer.

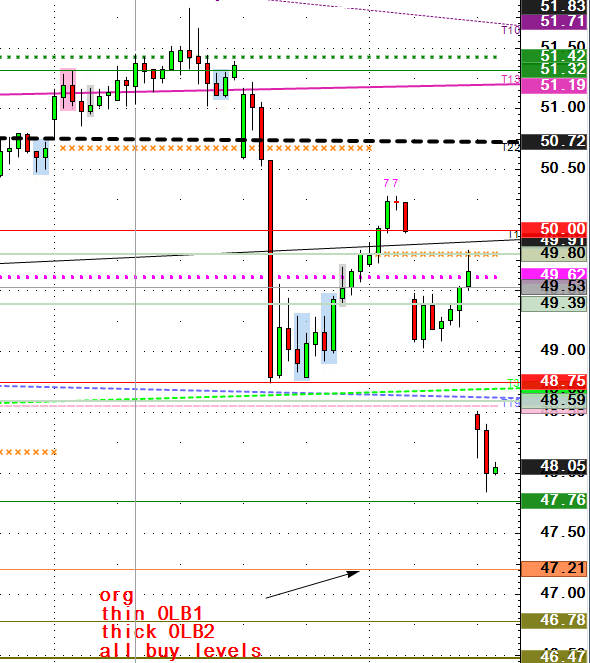

Crude Oil- opened day session under a whopping 6 macro levels and the high so far. Watch orange, thin olive, then thick for buy levels 1st time down for buys. Crude down 4% so far, this week folks. Biggest markets are here so let’s get tuned in.

46.47 s/b huge support, under 46.25 bull bets off. 44.88 next. Oil guys are starting to panic if we were to take dive and remember $29.00. Larger Macro we may rattle this cage.

July Soybeans- Auto pilot selling by funds is opinion. Beware $9.07 still sits as bear hook. Characteristics at olives is rampant bearishness. Does that apply? Sharp rally, ? 30 cents guess 20%. 9.095 low.

Meal- July 296.30 and 293.00 both OL buys OLBs.

Bean Oil, 30.87 OLB2, decent support, if hit over 31.32 flippant double up long, sell meal or beans if scared seems plausible. TL 31.21 low of day, stops under or accumulate.

Wheat- 423.4, 424.2 three levels. Hard to rally anything with beans tied as weight to grains.

Corn, tiny OLB1 366.6, 3.660 if bullish, 1 cent stop because more under, 364.25 big with sell stops under. Keep levels clean as I find this unexciting except for bean long trade cited. This trade has moved, 374.5 last. That’s the olive line reaction, sharp, counter trend but I say a value play. Only levels to play, over 377.5 could light up shorts, rally. Why would I want to short down here?

Inflation theme on hard breaks is my big picture. The drought is the grand slam but not for a month.

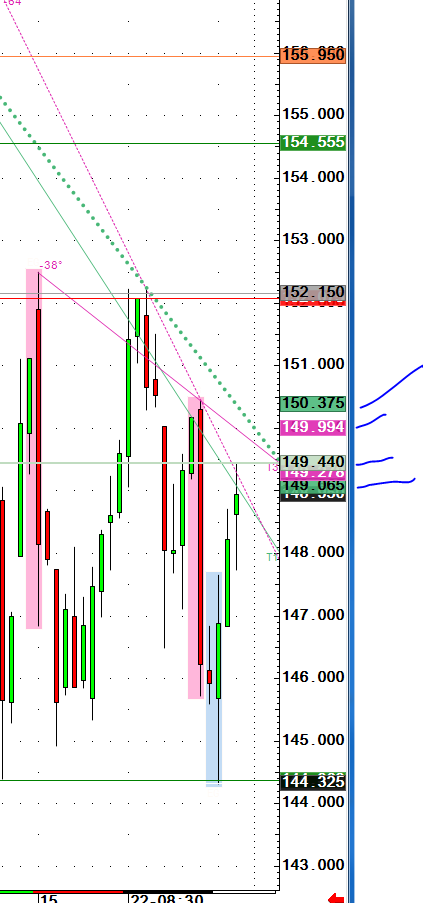

Bonds- Over OLS#2 153.12, 53.21 high, watch for possible failure selling if under and if under 253.04 stay short. Do not sell over OLS2. This is Santelli range from last year vertical, get it? 153.17 USU last, let’s watch this. It is not staying here..

Many well educated traders have sharply differing views. Whats M2 running? TOL.

Stocks- In my opinion no shorts overnight, o/n. Anyone short is a loser and while you can day trade shorts I think the public is camping short. NASD bulls can run wild to upside. Certain individuals are now over 1,000. 1,110 by Friday? Anything can happen so stay fresh because big trades of the year are coming, or here. Coffee comment ? Soft leaking but I do not cover except for clients as it is too much but let’s talk today.

Feeders and June Cattle, These look explosive to upside over these conditional allgorithm programmed trading systems. Limit up?