ARP HERE,

ALL OPINIONS,ESTIMATES,NEWS,THAT I PERCEIVE MOVE THE MARKET.

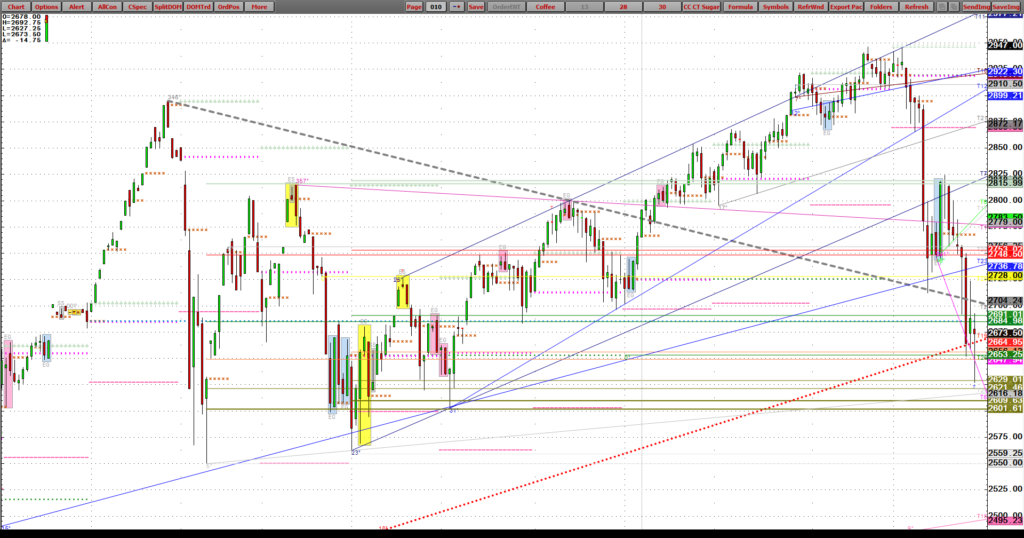

I have talked for some time in my posts that stocks are overvalued.

It is my belief the NASDAQ PE is silly high. My goal is to assist you in these extreme levels through the Olive Line.

In my approx 40 years of charting and trading the markets, these may become some of the most interesting trading times.

It is my belief we are in for exponentially more volatility.

I am watching the EU closely, Remember I called attention to the Italian rates, I am watching interest rates closely through Europe and the US.

If you have failed to see some of these things coming,perhaps you want to educate yourself on new tools. I advocate math applied indicators based on current pattern development.

The Algos run in herds in my opinion. My background and my love for charts, can assist by placing olive line patterns in front of you with daily levels. I have spent many years all the way back to my days with Tudor Jones attempting to perfect the Olive Line.

THOUGHTS FOR THE DAY

KC WHEAT – WE NEED TO BE CAREFUL UNDER 510 DEC. THIS MUST TURN, use stops

CORN – I have touted the buy side , as mentioned yesterday the blow off to the down side offers opportunity.

The corn trade yesterday, we had olive buys, talked about during the day. For those participating long now the market

is up. Is this the bottom? No sure things in commodities or life. That is why we rec STOPS.

STOCKS – I have looked for sell opportunities in stocks. The volatility can be difficult.

The markets have broken. Call now for OLB opportunities.

I am looking to assist you with the next trade opportunity.

Let me put you on the distribution list

Enjoy the weekend

ALAN

Walsh Trading, Inc. is registered as an Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (WTI) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

The information contained on this site is the opinion of the writer and obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in current market prices.