Need offer, Bil. bushels, and sell crude longs. [Weeks ago comment]

The way I envision this broker stab at helping Farmer’s, Ranchers, Speculators, Ethanol,

Option geeks,

Old Human Trader’s

From not get tattoo ed from the crazy 8′ $

DACA computer programmer Day Dreamers

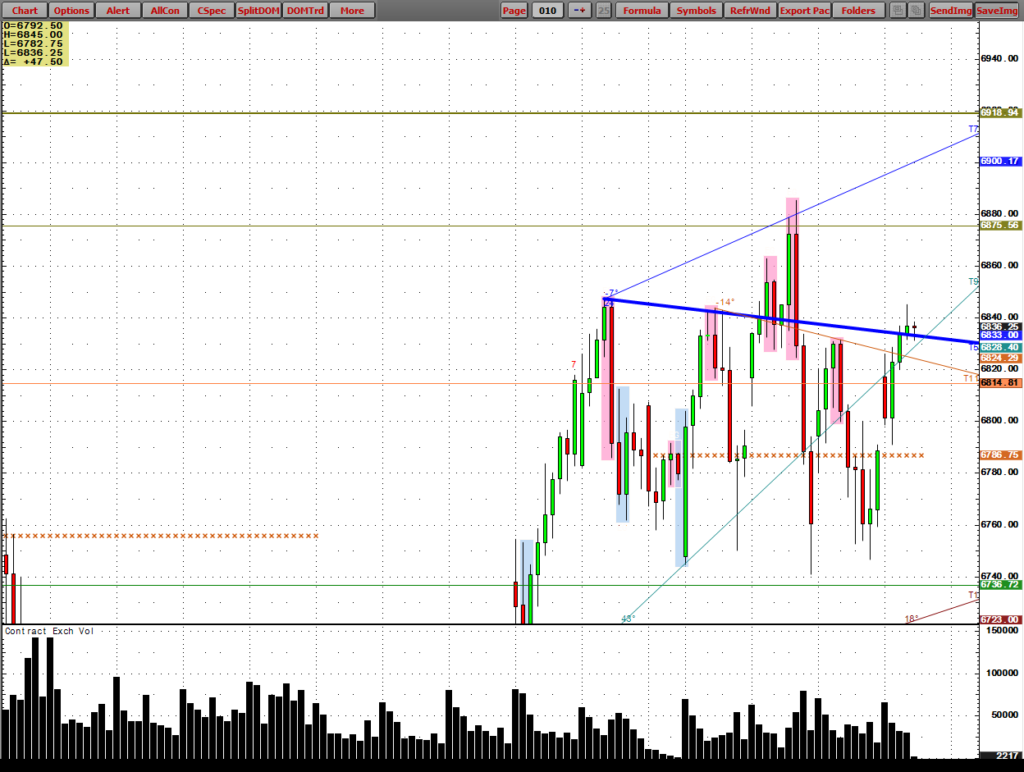

rammers (LCJ sell 1500 in 1min? freefall this week?

I can and am making it more;

relaxed for you with well placed stops,

while giving you market color that Pro Trader’s of all stripes use.

With solicitation on why you need another trading, hedge account, stressing exposure when you need it. What happens out there when you go down again? You may consider access let along strategic trading objectives.

You can get blind sighted for your inexpensive, do it yourself mental mind doink trading where you somehow

think you’re going to compete with the teams of Asian, Indian algo programmers? I tell my trader buddies they should consider while you can employ your own algo rules here, that offers opportunity.

A R&D project now underway. This is where you want to be. A Chicago clearing firm where a Chicago Pit Trader from the rough and tumble Trading floors of old human businessmen where gentlemen would intervene in futures disruption where a feeder auction around the country just happened to collapse specified minutes after Jan Feeder frenzy sell it all.

Substitute LCJ April cattle 2,500 1min vertical swan dive this week.

Concerted?

What one rule have I said is only way to trade? Use a what!

Good force-feed keyboard sucks, in case.

Use a stop always always! Come See what new clients, that teamed up with ARPy at Walsh, Straits, top of line Macro Analysis, looking for 20% moves in 2018 for you if so inclined. Paul Tudors Jones spoke on Feb 2. I have said you need to trade at Macro Extremes, he just said it publicly. Let me put 5-11 tick risk stops at only my levels. When we don’t get stopped out the payoffs are multiples of – risked capital per trade. US dollar sell 9040, 20 tick stop worked nice for 220, (2%) point down in week, now approaching again. Does your commercial provide that? What exactly do you get for 50?

If not then give me a call late next week. I have been saying months these are going to be the biggest most volatile markets in my decades trading my own money since I was 15, oats. Rules back then were your word of honor.

I specialize in spec small bets, insist really, on stops please but now branching out to your style.

Hedging your ethanol or other ways I can help out your Co-Op.

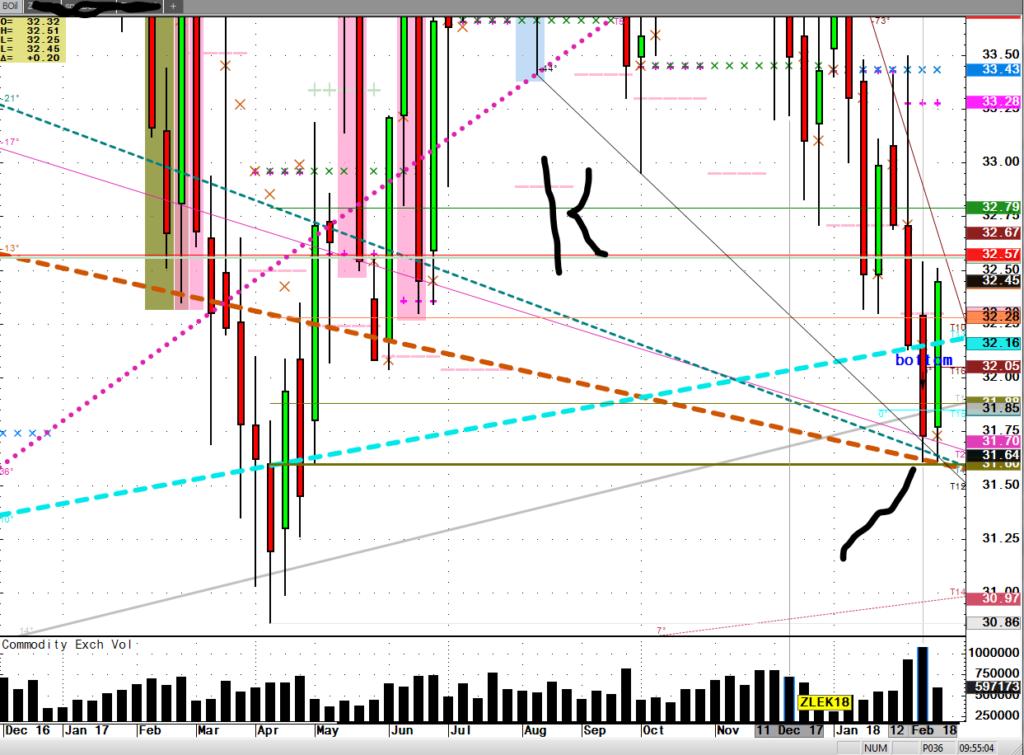

OS Oilshare is live live now for you momentum junkies, but be forewarned your analyst levels better be correct way. Get it? Long beanoil short meal in this squeeze.

I could see the long term, but had hard time floor trading it to reap these 2 bar fast, $5,k moves across floor. Expect macro dislocations, dollar fail?

Live mkts- cotton ols, sure olb, wk 426 olb pounding table ‘wheat causes cancer bull” and here come buy me a billion bushels funds in grains has been chirped in here. Pay retail and let’s see how it goes. What do you have to lose? Everything is live.

Can I make you a hundo?

The question then is;

Can you stay with a winner?.

Sold, CBOT floor definition;

Consummates buy or sold.

It worked great and you would scream it at the top of your lungs.

That’s how exciting I see this landscape.

Major bull market year 2 has come out with a bang. Gold plays macro lines but you need to work open order s everywhere. Coffee hit LT Tls 118.50. Feel lucky punk? Coffee char, 120 min,s of hell, 500 down happened last yr. Open now and play lines that are hidden but not from this pit rat pro. Sold~!

ARP@WalshTrading.com

If you sat on my trading couch, I explain just like @ $29 crude olb this can be viewed as investment at $4.10 buy until proven wrong type trade with leverage as funda mental ists chirped to ignore a decade of higher lows because this time for sure!

You were getting paid for bear bets.

Now Farmers were at the end of their rope if you will, and only 6 months of that

USE OF OPEN ORDERs because an Alan-ism is your not that ?, Because greed always sets in and traders dont talk about anything other than breaking rules. Open and I will share them.

Not an olive sell, that was wheat just a c hair under $6.00 depending on month of course. Cotton July hit ols, March meeting ssed by a what?

Do you think they use this? I said in December do not walk but run to open another account with me because chaotic markets immediately ahead.

Link

ARP@WalshTrading.com

$378.00- ! meal 19% macro tl bounce to ols consecutive action. Short squeeze high impact levels live, 4-20% fast moves is what I put in front of aggressive pit traders wanna bee;s. (Welcome)

I can help you be timid or bold in your face 5 -10 tick stops that play. .35, -.55c in meats, LHM btw hit apex at high last seconds, good sell, 1st time June hogs, forget handle, rancher sold. Sell Hogs and don’t get greedy is my aggressive opinion to long producers.

Si 15.84, PL $881, Gc, Sh 9.45 into USDA, Corn near olb miss but wheat, bo hit, oilshare down here my momentum players. I can do for you.

I advise you use more of your money to play mult units because I need margin money to catch cotton if you want to play event laden algo ripping straight down silver then straight up 14 days

right from where we started. These in bonds now, Blue diamonds if you dare buy bonds. Repatriation money going to buy bonds? I’m here with any idea you can imagine.

WT heck are you waiting for? I give you my floor trading honor the patterns are everywhere and this algo detector, provides multiples of capital risked from where tight stop is placed. I specialize in stop placement for customers. This comes from a floor trading professional that finds the next big move.

Notionally for example my wheat explosive comments sees wheat now up 10% + off Dec lows. Like last year! Did your guy, enough. Crude borke $8k and now up $5.5k into sell level strategies.

I you didn’t buy your feed needs in Dec like posited here, all these could have been lows for years to come in my opinion. Buy inflation now. Today bonds condition is live. Let’s see Monday, 3.22% high, 2.97% in 10’s.

Best Always and give me a call or shoot an email to get

the best dope. . .

on the markets.

When markets go vertical, you need a money colored- olive

Best of pattern recognition to all,

ARP CBOT

https://portal.straitsfinancial.com/user/register.aspx?brokerid=268